Navigating the Terrain of CD Rates: A Guide to Maximizing Your Savings

In the realm of personal finance, Certificate of Deposit (CD) rates play a pivotal role in helping individuals grow their savings. Whether you're a seasoned investor or a newcomer to the world of financial planning, understanding CD rates is essential for making informed decisions about your money.

Related searches

Understanding CD Rates: The Basics

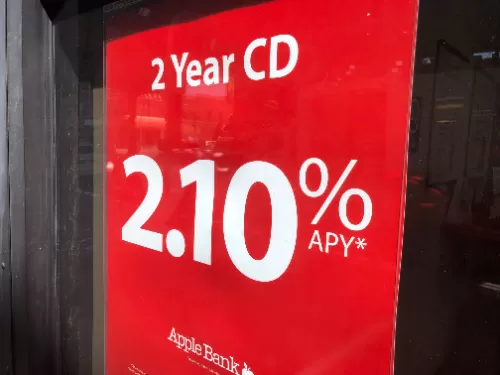

At its core, a Certificate of Deposit is a time-bound savings account that offers higher interest rates compared to traditional savings accounts. CD rates, determined by financial institutions, dictate the amount of interest you'll earn on your investment over a specific period, typically ranging from a few months to several years.

Comparing Rates: Finding the Best Deal

When exploring CD options, comparing rates is paramount. Different banks and credit unions offer varying rates based on factors such as market conditions, deposit amount, and term length. By researching and comparing rates from multiple institutions, you can identify the most competitive offers and maximize your earning potential.

Factors Influencing CD Rates

Several factors influence CD rates, including economic indicators, inflation rates, and central bank policies. In times of economic stability and low inflation, CD rates tend to be lower. Conversely, during periods of economic uncertainty or rising inflation, CD rates may increase to attract investors seeking safer investment options.

Strategies for Maximizing Returns

To capitalize on CD rates, consider employing strategic savings techniques. For instance, "laddering" involves dividing your investment across multiple CDs with staggered maturity dates. This strategy allows you to access funds periodically while taking advantage of potentially higher rates on longer-term CDs.

Navigating Rate Fluctuations

CD rates are subject to fluctuations based on market dynamics and economic trends. While locking in a favorable rate can provide stability and peace of mind, it's essential to remain flexible and adapt to changing conditions. Monitoring interest rate movements and staying informed about economic developments can help you make informed decisions about your CD investments.

Harnessing the Power of CD Rates

In the realm of personal finance, CD rates serve as a cornerstone of wealth-building strategies. By understanding how CD rates work, comparing offers, and employing savvy savings techniques, individuals can harness the power of CD investments to achieve their financial goals. Whether you're saving for a short-term objective or planning for long-term growth, navigating the terrain of CD rates is key to optimizing your savings journey.